Effective 2 May 2013, the Interbank money transfer of Interbank GIRO (IBG) transfer charge is reduced to only RM 0.10.

However, the Instant Interbank Fund Transfer (IBFT) service charge is reduced to only RM 0.53 (Service fee RM0.50 + GST RM0.03) from Jun 2015.

Bank Negara Malaysia (BNM) said that the low IBG fee is a new pricing strategy to promote greater efficiency. Individuals enjoy the convenience of transacting anytime anywhere, avoiding the queues at bank counters.

Businesses can lower the costs of doing business through the reduction or redeployment of resources used for handling cash and cheques.

How much fee & GST do I have to pay for an IBG transaction?

Only the IBG transaction fee is subject to GST and not the amount of cash transferred. If you are using online banking for IBG transactions, you will be charged *RM 0.11, inclusive of GST (RM0.10 fee + RM0.01 GST).

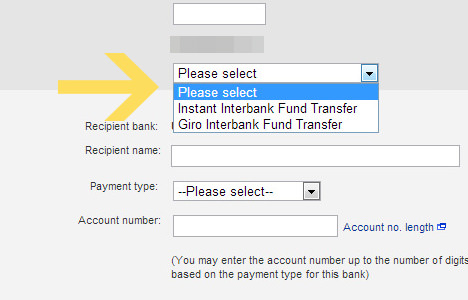

However, most of the bank in Malaysia including RHB Bank and UOB Bank launched another similar service which is known as Instant Interbank Fund Transfer (IBFT).

We can perform real-time fund transfer, credit card and loan payment. The transfer charge is RM 0.53 per transaction inclusive of Government and Service Tax (GST). We can transfer up to RM 30,000 daily with Instant transfer and our beneficiary can receive the money immediately.

So, be careful when you want to transfer money to other bank’s account.

Here is the comparison table between the IBG and IBFT.

| Interbank GIRO transfer (IBG) | Instant Interbank Fund Transfer (IBFT) | |

|---|---|---|

| Transfer Charge | RM0.11 (Service fee RM0.10 + GST RM0.01) | RM0.53 (Service fee RM0.50 + GST RM0.03) |

| Daily Transfer Limit | RM 30,000 | RM 30,000 |

| Transfer Schedule | Weekday before 12pm, same day Weekday after 12pm, next business day (NBD) Weekend & public holiday, next business day (NBD) | Immediate |

The post Interbank Money Transfer: IBG vs IBFT appeared first on MisterLeaf.